Johnson & Johnson tops the list of the most active corporate MedTech investors

Venture Capital

Over the past decade, more than $60 billion has been invested in startups working at the intersection of medicine and technology.

In 2020 alone, VC investment in MedTech increased by one-third from the year before, to over $16.7 billion. This spike was primarily driven by the pandemic pushing healthcare services out of hospitals into people’s homes, which opened up entirely new opportunities for remote health services—something Venture Capitalists, in their pursuit of “digital services replacing traditional jobs done by people in the physical world,” love to bet on.

Corporate Venture Capital

But the MedTech sector is not only heavily backed by classic Silicon Valley-based VCs. More and more corporations, most often through their respective Corporate Venture Capital (CVC) arms, are eying the MedTech sector.

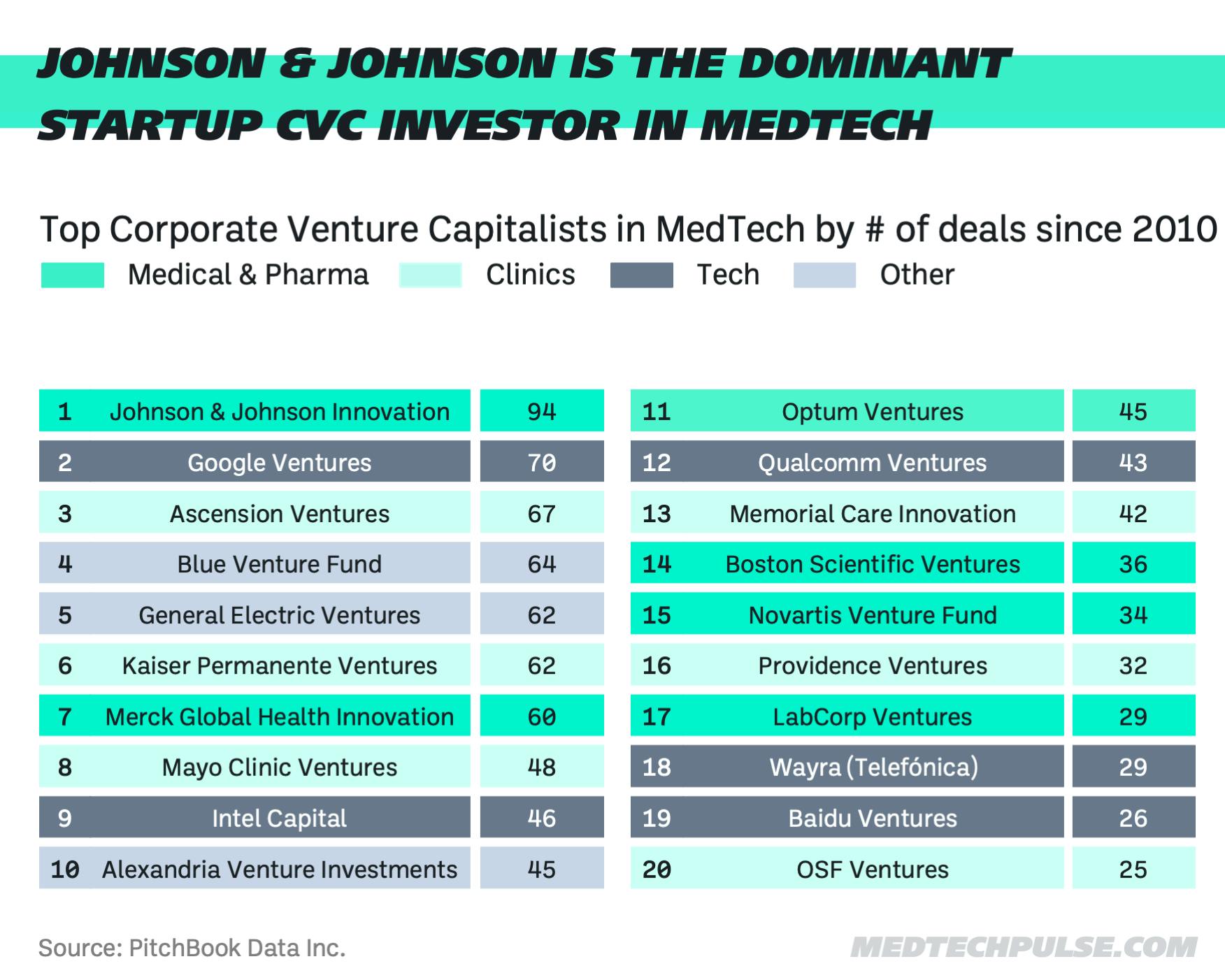

We took a look at the most active CVCs in MedTech. These investors are ranked by the number of MedTech deals they inked new, or the follow-on deals they made from 2010 forward—and the list excludes the CVCs of investment banks and financial holdings.

Interestingly, the list is NOT dominated by corporations from the medicine and pharma industry, as one would expect. These companies only represent six of the 20 most active investors. Another six investors are clinic owners, five companies are based in the technology space, and the remaining three companies originate from entirely different industries like insurance (Blue Venture), industrials (GE), and real estate (Alexandria).